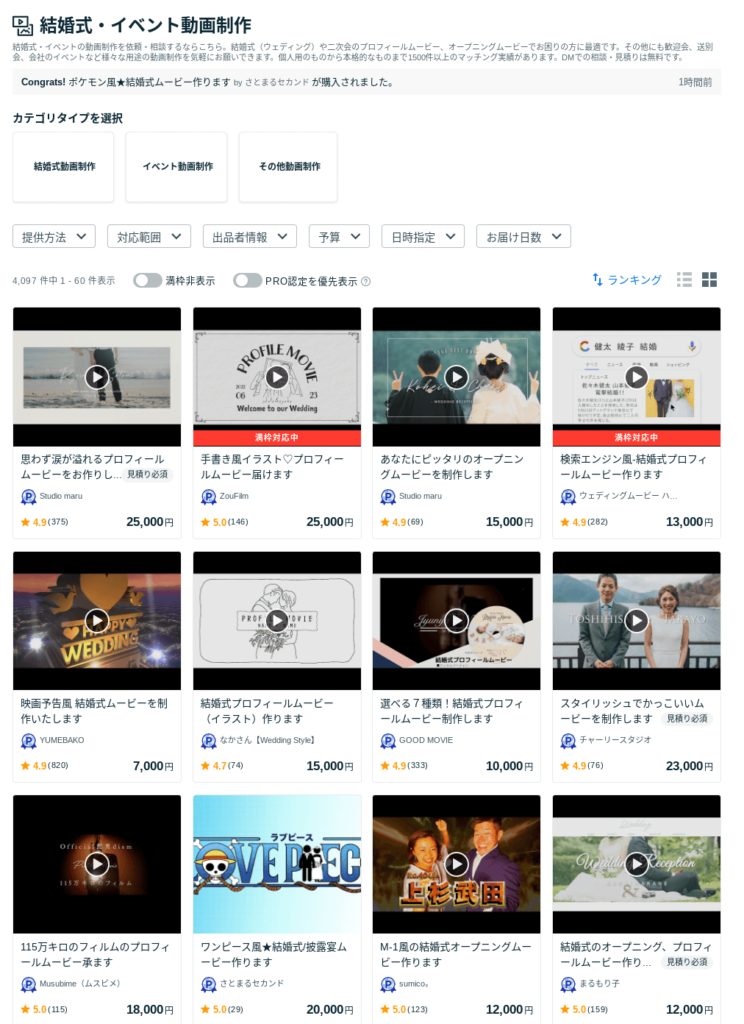

コロナ期間限定価格♫オシャレな♡ウェディングムービー ウェブサイト風

(税込) 送料込み

商品の説明

大人気のウェブサイト風プロフィールムービーです!

「おしゃれ・かっこいい・大人っぽい」が披露宴のコンセプト、

センスのいいムービーを好む方におすすめです。

毎月50組以上の新郎新婦様のムービー制作のお手伝いをさせていただいております。

安心してご依頼くださいませ。

おふたりの門出を彩るお手伝いができますよう丁寧にサポートいたします。

ぜひパートナーとしてお選びいただけますと幸いです。

サンプルや過去動画はInstagramかYou Tubeで閲覧可能

(お取引はメルカリでいたします)

サンプル以外のムービーも作成可能です♡

お気軽にご相談くださいませ。

✔フリー音源を使用した価格です。

✔お急ぎ対応可能です!

◎お値段以上のムービーを作成いたします!

◎プロ目線、ウエディング経験者の立場から、ゲストに飽きさせない長さでの演出をご提案いたします。

◎ご相談しながら、ご納得いただけるMovieを一緒に作成いたします❣

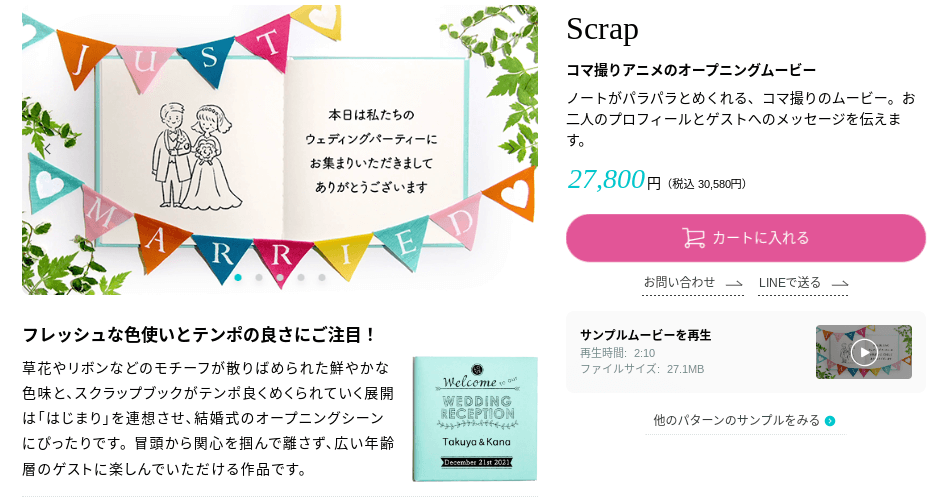

オープニングムービー

エンドロール

プロフィールムービー

プライズムービー 余興ムービー レタームービー サンクスムービー等

どんなムービーでも作成可能です!

◆ご購入までの流れ◆

①納期についてご連絡お願いいたします。

提示価格はデータいただいてから納期まで3週間以上余裕のある場合となります。

②専用ページを作成させていただきます。

◆ご購入後、動画制作の流れ◆

①購入手続き完了後、データ類の送付方法をご連絡いたします。

②動画完成後、ご確認していただきます。

③お手直し後、DVDを郵送させていただきます。

ウエディングアクセサリー出品してます

☞ #AccessoryMay

ウェルカムボード

ウェルカムスペース

ウェディングフォト

ブライダルムービー

結婚式ムービー

ウェディングムービー

動画作成

動画作成依頼

お洒落動画

結婚式 挙式 披露宴 二次会 2次会 パーティー お色直し 前撮り ティアラ ネックレス イヤリング ヘアアクセサリー ヘッドアクセサリー ヘッドドレス 花嫁 カジュアルウエディング ブライダルピアス 海外ウェディング商品の情報

| カテゴリー | ハンドメイド > その他 |

|---|---|

| 商品の状態 | 新品、未使用 |

コロナ期間限定価格♫オシャレな♡ウェディングムービー ウェブサイト

コロナ期間限定価格♫オシャレな♡ウェディングムービー ウェブサイト

みー様 最優先 8/21までの制作ご希望 - その他

結婚式ムービーを格安制作|エターナルムービー

marryコラボ作品!海外の雑誌風のスタイリッシュなプロフィール

.png)

プロフィールムービー「Happysite」 | 結婚式ムービーココロフィルム

コロナ期間限定価格♫オシャレな♡ウェディングムービー シネマ風

冬バーゲン D 2023の最新品種!「いちごキャンディ」大ぶり母の日

OFF半額 ♡様専用ページ【100mm】 zarooriashia.com

コロナ期間限定価格♫オシャレな♡ウェディングムービー ウェブサイト

プロフィールムービー 検索エンジン風

結婚式ムービーを格安制作|エターナルムービー

沖縄といえばビーチで!♡(公開日:2023年6月27日)|CREATIVE STUDIO

梅雨に負けず楽しんで撮影していきましょう〜〜!!!(公開日:2023年

ウェディングフォトはぜひcapry沖縄へ!♡(公開日:2023年6月16

プロフィールムービー 検索エンジン風

ポージングに困らない/撮影をより充実させるためには♪(公開日:2023

公式】滋賀|ウエディングドレス|ラ シャンブル デ ロッタ by HIROTA -

結婚式ムービーを格安制作|エターナルムービー

いよいよ7月に突入いたしました!!(公開日:2023年7月1日)|capry

italian wedding - Lemon8検索

ほぼ未使用 LOEWE コインカードホルダー ロエベ リピート エナメル

感染症対策 コロナ対策 オープニングムービー 優しい雰囲気のイラスト

marryコラボ作品!海外の雑誌風のスタイリッシュなプロフィール

いたずら好きな使い魔OFR - ヴァイスシュヴァルツ

結婚式ムービー】外注おすすめランキングベスト5!安くておしゃれ

プロフィールムービー(結婚式ムービー)ならファビオ ウェディング

最新体験レポ】今だけ超お得な割引も!千葉に新登場した“旅”がテーマの

2024年2月最新】ハナユメのキャンペーン徹底解説!最大64,000円の特典

沖縄で素敵なお写真撮影しませんか?(公開日:2023年6月17日)|capry

最安挑戦! ハープ プチタック petit 脱毛器 Tack JOVS tack 仮着機

プロフィールムービー(結婚式ムービー)ならファビオ ウェディング

幸三郎ウェディング | ブログ

セール開催中 降霊術‐霊視‐守護霊‐占い鑑定 その他 uxboost.com

プロフィールムービー 検索エンジン風

【WEBサイト風】結婚式オープニングムービー

プロフィールムービー(結婚式ムービー)ならファビオ ウェディング

プロフィールムービー(結婚式ムービー)ならファビオ ウェディング

結婚式ムービー】外注おすすめランキングベスト5!安くておしゃれ

席札 手作り スマホ - Lemon8検索

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています